If you’re planning to relocate to the US, it is important to know that your credit history from your home country does not travel with you – each international country uses a different system to evaluate and track credit.

So, even if you have no debts or flawless repayment records, you will still start off in the US with a credit score of zero – a completely blank slate. This will create some challenges as you acclimate to life in the United States. But by knowing what’s ahead, you can prepare and plan as needed.

Here’s what you need to know about your international credit in the US.

What is credit history?

A person’s credit history represents their ability to repay a borrowed debt, usually through loans or credit card purchases. Most lenders in the US, including banks, brokers, and landlords, look at a credit score to see whether you are credit worthy – trustworthy enough – to repay a loan or make monthly payments.

What is a credit score?

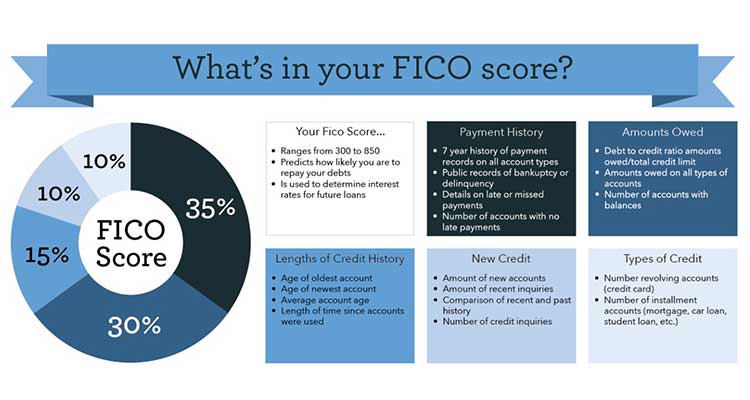

The most common scoring method in the US is the FICO® credit model. Each score is a three-digit number and typically ranges from 300 to 850.

Scores are calculated by individually created credit reports from the top three credit bureaus in the United States: Equifax, Experian, and TransUnion.

A higher score indicates that a person may be less risky to lenders because they most likely pay their bills on time. A credit score over 700 signals good credit management, which can mean lower interest rates on loans and higher credit card limits.

Photo Credit: DePaul University

Photo Credit: DePaul University

A FICO® credit score is determined by five components:

- 35% Payment history

- 30% Amounts owed

- 15% Length of credit history

- 10% Types of credit

- 10% New credit inquires

The longer a line of credit is active the better it is for a credit score.

Why credit history matters

Most lenders in the US turn to credit scores to decide whether someone can make the full repayment. A lack of credit history is basically the same as having bad credit history.

This can make it difficult for an international expat when trying to obtain a loan for essential items such as a car or housing. Your credit score can even affect your ability to get a cell phone.

What to do as an expat without a credit history

While it may seem like a daunting task to start your new journey in the US with a credit score of zero, as an expat you do have options:

There are companies that specifically cater to the needs of the relocating expatriate community.

Instead of relying on a credit history to determine your creditworthiness, these companies take other factors into consideration.

Working with expat-friendly companies will allow you to finance or lease a vehicle, secure housing, and get a mobile phone all without having a local credit history.

Once you are able to secure credit for these items this will start the process of building the foundation of your US credit score as you repay these loans.

IAS is expat friendly

Financing or leasing a vehicle is a great way to start building a credit history in the United States.

For over 25 years, International AutoSource (IAS) has specialized in serving the needs of the global mobility community. Through IAS, expats can get the car they need and get approved for a loan at similar rates to what an American would pay, all without needing a US credit history.

IAS provides full-service transportation solutions—from initial consultation, quote, finance and leasing, delivery, registration, and licensing. Expats also access safeguards and assurances not found anywhere else in the industry.

About International AutoSource

As the vehicle experts for expats, International AutoSource has helped assignees relocating on an international assignment with flexible vehicle solutions to finance, lease or rent a vehicle in the US without a local credit history.

Our factory-backed financing programs for foreign executives, healthcare workers, business professionals, students, teachers, and the diplomatic community feature low rates and are designed to get expats approved quickly and easily.

Choose from top-selling models from Audi, Chrysler, Dodge, Ford, Honda, Infiniti, Jeep, Lincoln, Nissan, Ram, Toyota, and many more.